Summary Highlights:

- Filing a storm damage insurance claim for a commercial roof requires fast action, detailed documentation, and expert guidance.

- Delayed response can lead to denied claims, water damage, or full replacement costs.

- Inspections by a certified commercial roofing contractor help validate the scope of damage.

- WaterTight Roofing helps property owners through the claim process—from inspection to final repairs.

Why Is It Crucial to File a Roof Storm Damage Claim Quickly?

As a commercial roofing contractor, I've seen the toll that storm damage can take on a property—from soaked insulation and ceiling leaks to compromised membranes and structural issues. But what makes or breaks a property owner's recovery? It's how quickly and thoroughly they handle the insurance claim.

When your commercial roof is hit by hail, wind, or heavy rain, time matters. Insurance companies have filing windows, and damage that goes unaddressed—even for a few days—can get worse or be written off as "neglect." At WaterTight Roofing, we help you get ahead of this process, protecting your investment and maximizing your claim.

What Should You Do Immediately After a Storm?

Stay Safe and Don't Go on the Roof: Storm-damaged roofs can have soft spots, loose materials, and hidden water intrusion. Focus on observing from the ground—look for detached flashing, fallen branches, or signs of interior leaks.

Document Everything: Take photos and video of all visible signs of damage, inside and outside. Capture broken ceiling tiles, wet insulation, missing roof panels, or storm debris around your building.

Notify Your Insurance Company: Most policies require prompt notification after a loss. Even if you're not sure how severe the damage is, initiate the claim to get the process started.

Call a Commercial Roofing Expert: An inspection from a licensed commercial roofer ensures all damage is discovered, not just what's visible. At WaterTight Roofing, we provide detailed reports with photographic documentation, moisture readings, and estimates required by your adjuster. As an experienced commercial roofer for insurance loss evaluation, we act as your advocate—ensuring that nothing is overlooked, underreported, or undervalued.

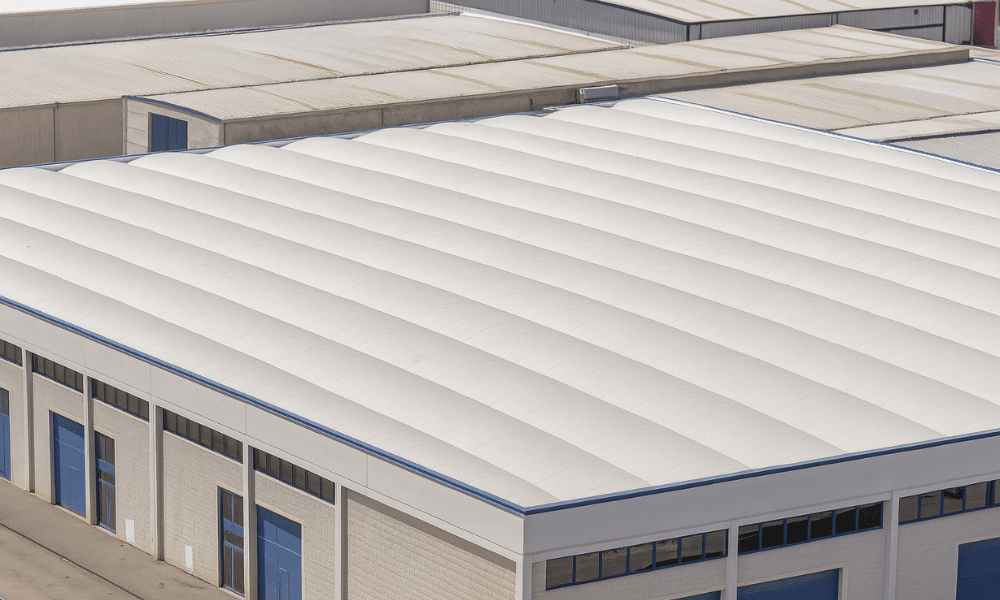

What's Included in a Commercial Roof Storm Damage Inspection?

When we perform an inspection for an insurance claim, we focus on:

- Roof membrane condition (TPO, EPDM, PVC, or modified bitumen)

- Metal panel damage, fastener displacement, or seam separation

- Flashing and edge integrity, especially around HVAC units and skylights

- Moisture mapping to uncover trapped water or insulation damage

- Ponding water or failed drainage issues

- Interior evidence of leaks or ceiling damage

We compile all findings into an easy-to-read report that supports your claim and confirms your roof's condition at the time of the storm.

How Can a Roofing Contractor Help With the Claims Process?

You're not alone when filing a commercial roofing insurance claim. At WaterTight Roofing, we help you navigate every step, including:

- Meeting with your insurance adjuster on site to ensure nothing is missed

- Providing accurate repair or replacement estimates

- Recommending whether repair, restoration, or full replacement is needed

- Explaining manufacturer warranty options and how they interact with your claim

- Performing emergency tarping or sealing to prevent further damage

We've worked with major insurance carriers throughout Texas, and we understand how to advocate for your best interests.

What If the Insurance Company Denies or Undervalues My Claim?

It's not uncommon for initial claim assessments to come back lower than expected, especially if the adjuster didn't do a detailed roof inspection. That's where your roofing partner matters most. We can submit supplementary documentation, re-inspect with adjusters, and provide evidence that justifies a proper repair or replacement.

If your policy includes "replacement cost value," don't settle for a patch job. We'll help ensure your coverage is applied correctly so your roof is restored to pre-loss condition or better.

How Can You Prevent Future Storm Claim Complications?

While you can't control the weather, you can take proactive steps to protect your commercial property—and your bottom line—when the next storm hits. Here's how to reduce complications with future insurance claims:

Schedule Bi-Annual Commercial Roof Inspections: Regular inspections in the spring and fall help identify wear, membrane fatigue, and drainage issues before they're exposed by severe weather. These checkups provide a documented history of your roof's condition.

Keep Detailed Maintenance Records: Having a clear record of inspections, repairs, and upgrades shows your insurance provider that you've maintained your roof responsibly. This due diligence supports your claim and reduces the risk of denial based on "lack of maintenance."

Address Small Issues Before Storms Amplify Them: Even minor seam separations, clogged drains, or flashing gaps can turn into costly leaks during a storm. Taking care of these early minimizes the chance of widespread damage and accelerates post-storm repairs.

Know When to Use Temporary Repairs for Commercial Roof After Storm Damage: If a major storm strikes and full repairs can't happen immediately, document the damage and install temporary protection such as emergency tarping or sealing. At WaterTight Roofing, we respond quickly with temporary repairs for commercial roofs after storm damage to mitigate further loss and support your insurance filing.

Partner with a Commercial Roofing Expert: Working with a roofing partner like WaterTight Roofing—who already knows your roof system and your insurance carrier—means faster evaluations, better documentation, and less stress when filing your claim.

These steps make your future claims easier to verify and harder for insurance companies to contest.

Has Your Roof Been Damaged by a Storm?

Even if you don't see visible leaks, storm damage can quietly compromise your commercial roof's integrity—leading to bigger issues down the road. Don't wait for the damage to spread or for the insurance company to question your timeline.

Contact WaterTight Roofing today at 888-809-9976 for your FREE storm damage roof assessment. Our experienced team will thoroughly inspect your roof, document all findings, assist with insurance claims after storm damage, and deliver expert repairs or replacement to fully protect your building again.

Ready to take action? Call now or schedule your post-storm roof evaluation online. Let's protect your investment—together.

FAQs About Insurance Loss Evaluation

Why Trust WaterTight Roofing

WaterTight Roofing is Texas's go-to expert for commercial and industrial roofing solutions, proudly serving Fort Worth, Austin, and surrounding communities since 2011. With over 20 million square feet of commercial roofing installed, we specialize in flat and low-slope systems, storm damage restoration, insurance loss evaluations, roof replacements, and energy-efficient roof coatings. As trusted partners to property managers, business owners, agricultural operators, and facility directors, we deliver durable results with unmatched integrity.

At WaterTight Roofing, we're not here for one-time fixes—we're here to protect your property and bottom line for the long haul. From inspection to installation, our team is committed to quality, clarity, and client-first service every step of the way.

Blog subscribers get new resources and how-to guides delivered via email.

Your Business Relies On Staying Dry